What You Need to Know About Stamp Duty

When jumping into the property market, it pays to do your research. As the biggest purchase most Australians make, it’s important to understand each step of the process and all the associated costs involved – the additional taxes and fees to your home loan should be fully understood too, and the biggest of these is known as Stamp Duty.

Stamp Duty is a term widely used in the property market, but asides from an additional cost to your home loan, and a fairly big one at that, what is the tax for, and why does it differ per state? We aim to answer these questions and more so you can continue with your property search clued up on more of the costs involved.

What is Stamp Duty?

Stamp Duty, also known as Land Transfer Duty, is a tax payable on almost all home purchases in Australia. The tax is based on the purchase of real estate and covers the costs of changing over the title of the property as well as other homeownership details.

Stamp Duty now includes Foreign Buyers Duty which is applicable in some states for non-Australian Residents, and can be as high as $40,000 on a $500,000 property in NSW.

How and when do you pay Stamp Duty?

Property buyers are required to pay stamp duty costs up front, ie. when the transaction is finalised and contracts are exchanged. The exact time frame varies across state and territories. We’ve summarised the payable time frames in each state and territory below.

NSW – payable within three months of settlement

ACT – payable within 28 days of settlement

VIC – payable within 30 days of the property being transferred

QLD – payable within 30 days of settlement

SA – payable on settlement day

WA – payable within two months of settlement

NT – payable within 60 days of entering into the transaction or at settlement, whichever is earlier

TAS – payable within three months of a transfer occurring.

In the case of off-the-plan owner-occupied purchases, the purchaser could be eligible to defer paying Stamp Duty for up to 12 months. It is important to check the specific rules and regulations within each state and territories as there are some exceptions. Penalties and interest apply if stamp duty is not paid within the legislated time frame.

Your solicitor or conveyancer will be sent a Duties Notice of Assessment upon lodgement of assessment, which will include the total tax payable and the due date. Stamp Duty is typically paid at the time all funds are transferred during the settlement process.

Stamp Duty is not a tax that is added to your home loan to pay over the course of many years, but a lump sum payment required around the settlement date. It is a tax often overlooked when budgeting and saving for a 20% deposit on a home. You may think an exact 20% deposit of the property purchase price will remove any need for LMI (Lenders Mortgage Insurance), but when you factor in Stamp Duty and other associated costs, this may deplete your deposit significantly, and push you back into the boundaries of paying LMI on your mortgage. It’s imperative to factor in these extra costs when saving up for your all-important deposit.

How much does Stamp Duty cost, and how is it calculated?

There is no universal value placed on various estates and is instead provided by the state’s revenue offices. For this reason, Stamp Duty varies throughout Australia based on a number of factors:

- State

- State government grants

- Cost of property

Stamp Duty per State

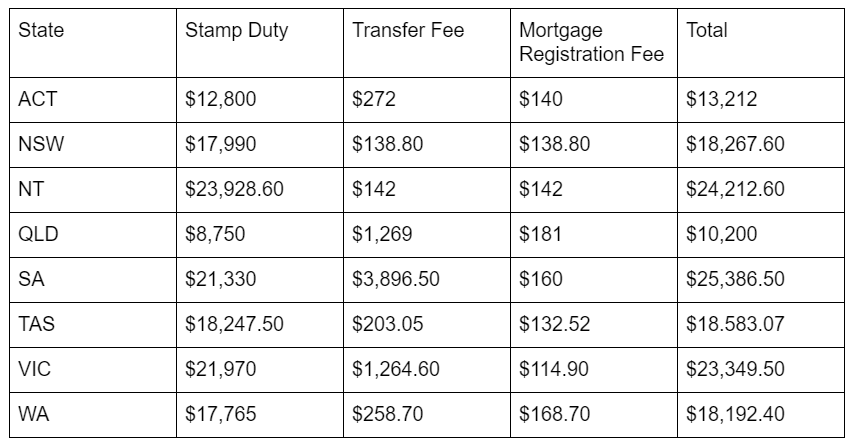

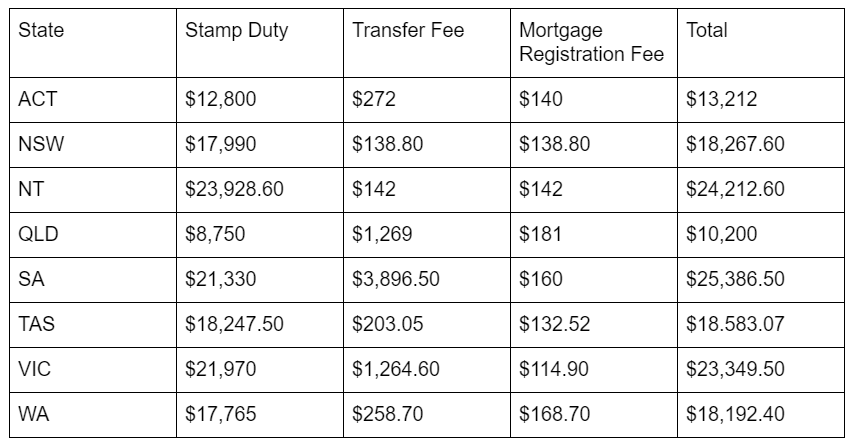

Stamp Duty paid in different states and territories will vary, though most tend to charge similar amounts. On a $500,000 property, the Stamp Duty payable per state (as per January 2019) is:

State Government Stamp Duty Grants

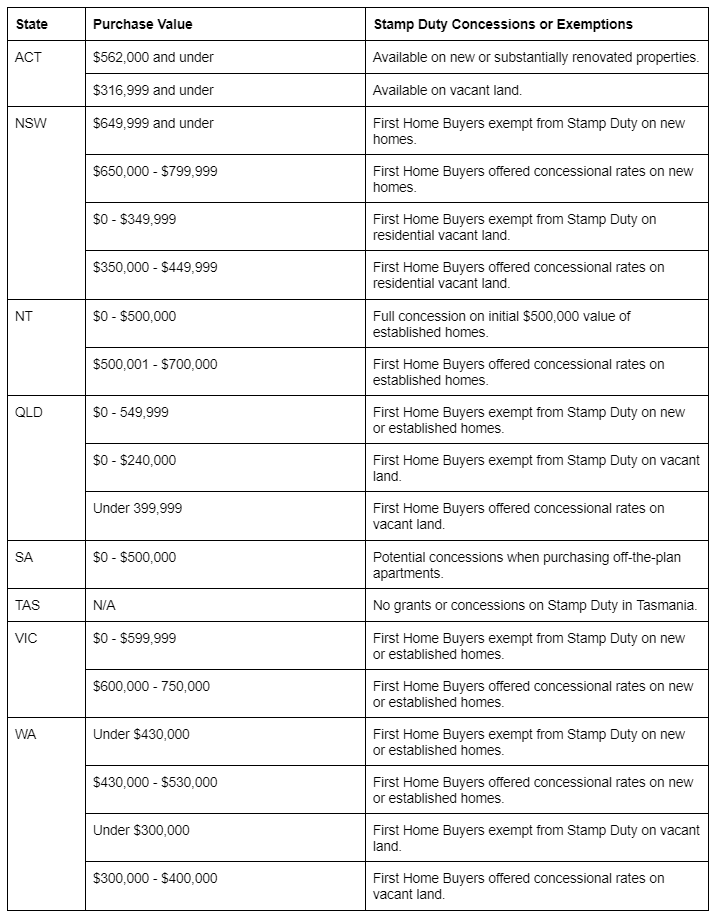

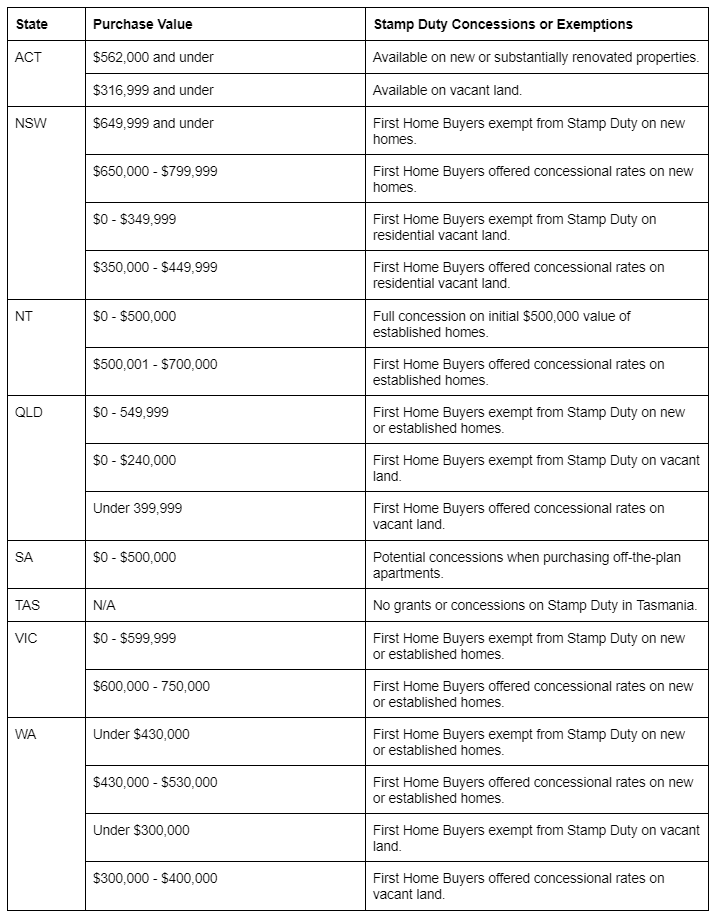

Most state governments offer First Home Buyer schemes that allow concessions or exemptions from paying Stamp Duty. The following table documents which states provide these handy discounts for First Home Buyers looking to get into the property market.

Source: Finder.

Stamp duty related to property prices

As per almost all taxes, the higher the purchase price, the more tax is payable. When it comes to purchasing property, this is no different: the higher your property price, the more stamp duty you will be required to pay. Again, the exact price thresholds vary on a state by state basis, but all properties within each state use the same Stamp Duty calculation according to their state government issued rates.

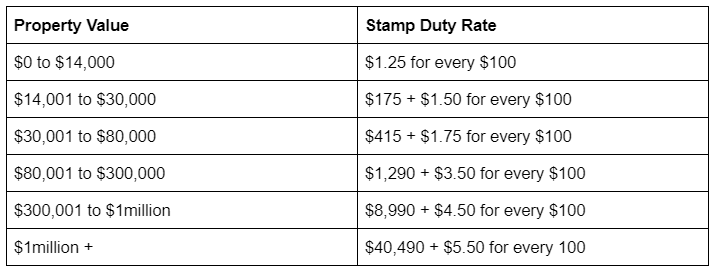

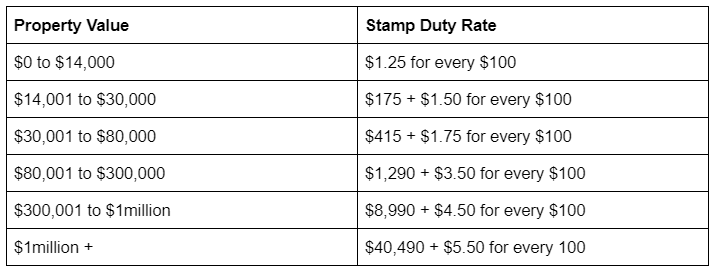

Using NSW as an example, there are 6 thresholds which increase the price of stamp duty per $100 of the property price. Saying this, the majority of properties in NSW only fall into the top two tiers.

Source: NSW Revenue

A $300,000 property would cost the average NSW home buyer or investor $9,267.60 in stamp duty fees, transfer fees and registration fees, whereas a property costing $350,000, just over the threshold, would cost the average home buyer or investor $11,517.60. Jump up to a property priced at $1.25million, and you’re looking at a costly $54,517.60.

To calculate your own Stamp Duty, use our handy Stamp Duty Calculator, which takes into account all state grants, concessions and regulations to offer you an accurate cost to budget for.

At Mortgage House, we are no stranger to the homeowner’s journey. It’s a long (but rewarding) one.

We’re committed to seeing you become a homeowner, and offering advice and assisting you with stamp duty is just part of what we do. For the best home loan products, support and help on all things home loans, contact us today or phone us on 133 144!